Fully Automated

We provide the fastest and most accurate identity verification solution.

Highly Flexible

Our KYC, KYB, and AML services are customised for any jurisdiction and business requirement.

Data Security

Maintain full control over data and get real-time support from our tech team.

XRAY: a modern identity solution for digital businesses.

Easy integration for global coverage. Verify your customers around the world with access to reliable and independent sources in more than 100 countries.

We help you build a frictionless identity verification process, scale operations globally and keep customer data secure by offering online identity service verifying customers instantly and providing global data coverage.

Keeping information protected and systems secure at all times.

EXPLORE COVERAGEKYC - Identity Verification

PEP, Watchlist & Sanctions check

2 Factor Authentication

KYB - Business Verification

Electronic IDs Verification

Document Verification

Real time AML checks

Address Verification

A Complete KYC Solution

Establish trust in every interaction by leveraging a comprehensive set of tools tailored to combat fraud, ensure compliance, and enhance the customer journey.

Pricing

BASIC

Pay as you go!

Great for small amount of checks from time to time

Personal Adverse Media (+PET +SL)

Personal sanctions (+PEP)

LIGHT

Great for up to 200 checks / monthly

Monitoring

Personal sanctions (+PEP)

Personal Adverse Media (+PEP +SL)

Government Identity check

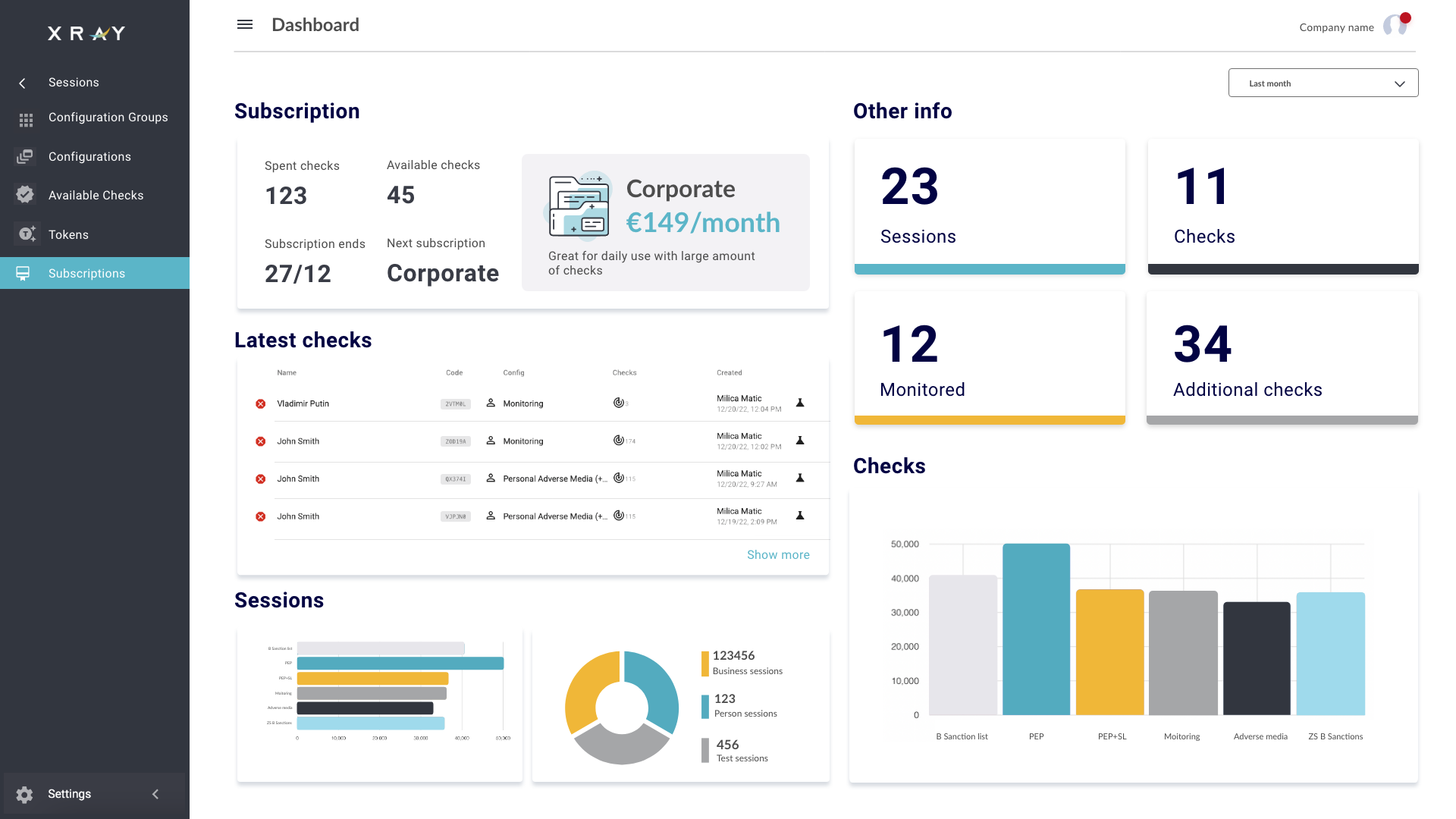

CORPORATE

Great for daily use with large amount of checks

Government Identity check

Business Sanctions +PEP

Business Sanction

Personal Sanctions (+PEP)

Personal Adverse Media (+PEP +SL)

Business Sanctions

Monitoring Too

Use cases

Customer onboarding

Consumers expect fast, secure digital onboarding when they open accounts. Avoid the pitfalls of slow, disjointed customer onboarding by leveraging a global identity verification platform that puts speed, security and growth at the forefront of your operations.

Regulatory compliance

Adjust to evolving regulations and enter new markets confidently with a single identity verification platform. XRAY connects you to more than 450 global and local data sources, 6,000 watchlists and 20,000 adverse media sources to amplify match rates, meet KYC and AML compliance, and fuel market expansion.

READ THE SUCCESS STORIES

As a Financial Institution the AML, KYC and KYB are one of the most important security measures that have to work perfectly. XRAY helps us keep our clients safe and secure reducing the risk of fraud to zero!

Adam Simonsson

Plusius

XRAY is the best solution aligned with our customer's compliance needs. Working within the remittance industry and providing tech solutions means having complementary solutions to match our standards.

Andreas Wickberg

Tango AML

Trusted by the Word's best companies

Frequently asked questions

© 2023 XRAY by TangoAML